05 Oct Boost Your Blockchain Project: Step-by-Step Token Deployment on DEXs

Introduction

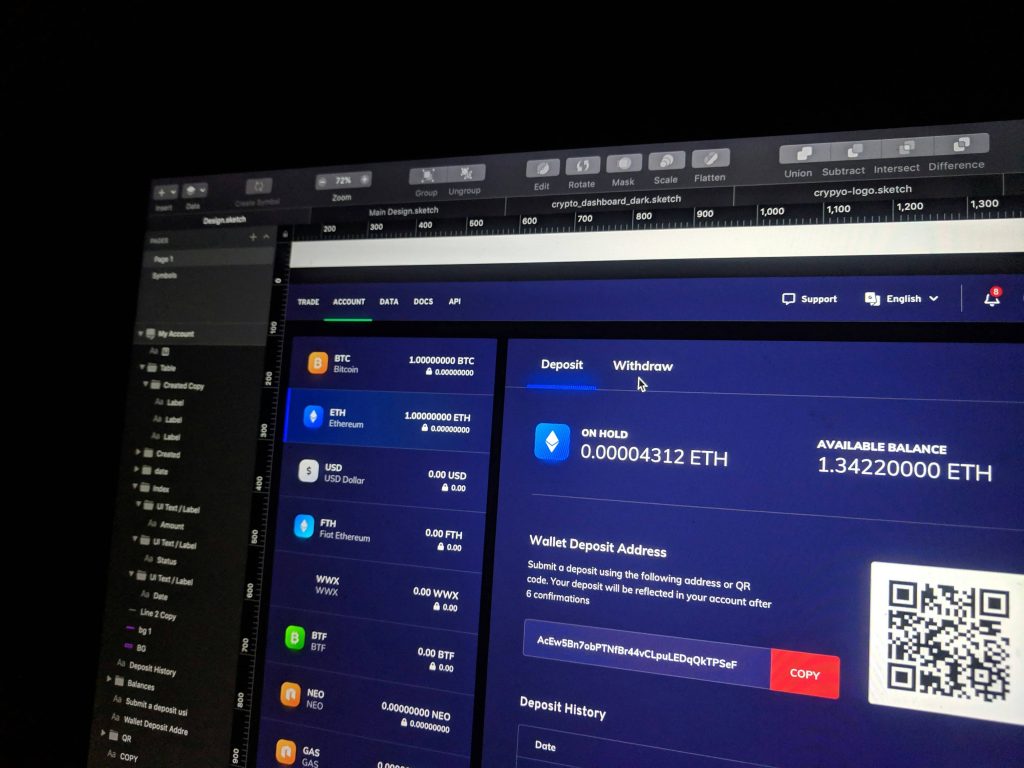

Decentralized exchanges (DEXs) are transforming the cryptocurrency landscape by enabling direct peer-to-peer trading without the need for a central authority. These platforms offer enhanced security, transparency, and control over assets, making them an attractive option for developers and users alike. Deploying a token on a DEX can significantly increase its liquidity and visibility, contributing to the overall success of your blockchain project. This guide aims to provide a detailed walkthrough of the token deployment process, from the initial design to managing and promoting your token post-deployment.

Understanding the Basics

To successfully deploy a token on a DEX, it’s essential to understand the foundational concepts and terminology involved.

Tokens and Their Types:

- ERC-20: A widely-used standard on the Ethereum blockchain, ensuring compatibility and ease of integration with various DApps and exchanges.

- BEP-20: A token standard on the Binance Smart Chain (BSC), offering fast transaction speeds and lower fees compared to Ethereum.

- Other Standards: Depending on the blockchain, you may encounter other standards like ERC-721 for non-fungible tokens (NFTs) or TRC-20 on the TRON blockchain.

CEXs vs. DEXs:

- Centralized Exchanges (CEXs): Operate under a central authority, providing features like high liquidity, user-friendly interfaces, and customer support, but with risks such as hacking and lack of control over assets.

- Decentralized Exchanges (DEXs): Enable direct peer-to-peer trading, offering benefits like enhanced security, privacy, and control, but can have lower liquidity and less user-friendly interfaces compared to CEXs.

Benefits of Deploying Tokens on DEXs:

- Security: Funds are stored in users’ wallets, reducing the risk of hacks.

- Transparency: All transactions are recorded on the blockchain, ensuring transparency.

- Control: Users have complete control over their assets without relying on intermediaries.

Preparing for Token Deployment

A successful token deployment starts with thorough planning and preparation.

Designing the Token:

- Choosing the Blockchain: Select a blockchain that aligns with your project’s goals. Consider factors such as transaction speed, fees, and existing ecosystem.

- Defining Purpose and Utility: Clearly define the token’s role, whether it’s for governance, utility, rewards, or other functions within your ecosystem.

- Setting Tokenomics:

- Total Supply: Decide on the total number of tokens that will ever exist.

- Distribution: Plan how tokens will be distributed among founders, investors, development, marketing, and community incentives.

- Allocation: Allocate tokens for specific purposes, such as liquidity pools, staking rewards, or future development.

Creating the Smart Contract:

- Overview of Smart Contracts: These are self-executing contracts with the terms directly written into code, ensuring automated and trustless execution.

- Writing and Testing Code: Use development environments like Remix or frameworks like OpenZeppelin to write your smart contract. Thoroughly test the contract to ensure it behaves as expected.

- Token Creation Platforms: Platforms like Remix, Truffle, and OpenZeppelin provide tools and templates to simplify the creation and deployment of smart contracts.

Securing the Token:

- Importance of Code Audits: Regular audits help identify and mitigate potential vulnerabilities in your smart contract.

- Hiring Professional Auditors: Engage reputable auditing firms like CertiK or Quantstamp to conduct thorough security reviews.

- Best Practices: Follow secure coding practices, such as using well-established libraries, avoiding unnecessary complexity, and regularly updating your codebase to patch vulnerabilities.

Setting Up the Development Environment

Creating a robust development environment is crucial for a smooth deployment process.

- Installing Necessary Tools: Install essential software such as Node.js, which provides a JavaScript runtime, Truffle for development and testing, and Ganache for creating a local blockchain environment.

- Setting Up a Local Blockchain: Use Ganache to simulate a blockchain on your local machine, allowing you to develop and test your smart contracts in a controlled environment.

- Connecting to a Testnet: Deploy your contract on a testnet (e.g., Ropsten for Ethereum or BSC Testnet) to conduct further testing under real-world conditions without incurring the costs associated with mainnet transactions.

Deploying the Token

Deploying your token involves both the testnet and mainnet deployment stages.

Testnet Deployment:

- Importance of Testing: Deploying on a testnet allows you to identify and fix issues in a safe environment before going live on the mainnet.

- Deployment Steps: Use tools like Truffle or Remix to compile and deploy your smart contract on the testnet. Verify that the contract functions correctly and that all interactions behave as expected.

- Verification: Check the testnet explorer (e.g., Etherscan for Ropsten) to ensure the deployment was successful and to review transaction details.

Mainnet Deployment:

- Transitioning from Testnet: After successful testing, prepare for mainnet deployment by finalizing your contract and ensuring all parameters are set correctly.

- Funding the Wallet: Ensure your deployment wallet has enough cryptocurrency to cover the gas fees associated with the deployment.

- Deployment Process: Deploy your smart contract on the mainnet using your preferred development tools. Verify the transaction status on the blockchain explorer.

- Confirming Deployment: Double-check that the contract is deployed correctly and that all functions work as intended on the mainnet.

Listing the Token on a DEX

Once your token is deployed, the next step is to list it on a decentralized exchange.

Choosing the Right DEX:

- Popular DEXs: Consider platforms like Uniswap (Ethereum), SushiSwap (Ethereum), and PancakeSwap (BSC) based on your token’s blockchain.

- Selection Criteria: Evaluate DEXs based on liquidity, user base, transaction fees, and ease of integration.

Adding Liquidity:

- Importance of Liquidity: Adequate liquidity is essential for facilitating smooth trading and preventing significant price fluctuations.

- Adding Steps: Deposit your token and the corresponding pair (e.g., ETH, BNB) into the DEX’s liquidity pool. Ensure you provide sufficient liquidity to support trading activity.

- Setting Trading Pairs: Establish initial trading pairs (e.g., Token/ETH, Token/BNB) to make your token accessible to traders.

Creating and Managing Pools:

- Liquidity Pools: These pools allow users to trade tokens directly from reserves, providing liquidity and enabling decentralized trading.

- Creating a Pool: Follow the DEX’s guidelines to set up a new liquidity pool. This typically involves depositing an equal value of your token and the paired asset.

- Monitoring: Regularly monitor the pool to maintain healthy liquidity levels and adjust as needed to support trading activity.

Promoting and Managing the Token

Effective promotion and management are key to the success of your token.

Marketing Strategies:

- Social Media and Forums: Leverage platforms like Twitter, Reddit, and Telegram to promote your token. Engage with the community by providing regular updates, hosting AMAs, and participating in discussions.

- Community Engagement: Foster a strong community by being responsive, transparent, and offering incentives like airdrops or staking rewards to encourage participation.

Continuous Development and Updates:

- Ongoing Development: Continuously improve your token’s ecosystem with new features, enhancements, and partnerships.

- Communication: Keep your community informed about updates, new developments, and any changes to the project. Regular communication helps build trust and maintain interest.

Legal and Regulatory Considerations

Navigating the legal landscape is critical to ensuring compliance and avoiding potential legal issues.

- Legal Requirements: Understand the regulatory requirements in the different jurisdictions where your token will be available. These can vary widely and may include securities regulations, anti-money laundering (AML) laws, and know-your-customer (KYC) requirements.

- Regulatory Compliance: Ensure your token complies with relevant regulations to avoid legal issues. This might involve registering with regulatory bodies or obtaining the necessary licenses.

- Professional Consultation: Engage with legal experts who specialize in blockchain and cryptocurrency to help navigate the complex regulatory environment and ensure your project adheres to all applicable laws.

Conclusion

Successfully deploying a token on a DEX requires meticulous planning, technical proficiency, and strategic marketing. By following this comprehensive guide, you can ensure a smooth deployment process and position your token for success in the decentralized ecosystem. Stay innovative, continuously engage with your community, and keep improving your project to contribute positively to the world of decentralized finance (DeFi). By adhering to these steps and best practices, you can navigate the complexities of token deployment and make a significant impact in the world of DeFi.

Key Takeaways

Understanding DEXs and Tokens | DEXs enable direct peer-to-peer trading, enhancing security, transparency, and user control. |

Common token standards include ERC-20 (Ethereum) and BEP-20 (Binance Smart Chain), each with unique benefits and compatibility. | |

Token Deployment Preparation | Choose a suitable blockchain based on project goals, transaction speed, and fees. |

Define token purpose, utility, total supply, and distribution plan. | |

Create a secure smart contract using tools like Remix, Truffle, and OpenZeppelin, and ensure thorough code audits. | |

Setting Up the Development Environment | Install the necessary development tools (Node.js, Truffle, and Ganache). |

Set up a local blockchain environment for controlled testing. | |

Deploy the token on a testnet (e.g., Ropsten for Ethereum) for real-world testing without incurring mainnet costs. | |

Token Deployment Process | Conduct thorough testing on a testnet to identify and resolve issues. |

Transition to mainnet deployment, ensuring adequate funding for gas fees. | |

Verify successful deployment on the mainnet and ensure all functions work as intended. | |

Listing the Token on a DEX | Choose a suitable DEX (e.g., Uniswap, SushiSwap, PancakeSwap) based on liquidity, user base, and transaction fees. |

Provide adequate liquidity to facilitate smooth trading. | |

Create and manage liquidity pools to support decentralized trading. | |

Promoting and Managing the Token | Use social media and forums to promote the token and engage with the community. |

Offer incentives like airdrops and staking rewards to foster community participation. | |

Continuously improve the token ecosystem and maintain transparent communication with the community. | |

Legal and Regulatory Considerations | Understand and comply with regulatory requirements in jurisdictions where the token will be available. |

Engage legal experts to navigate the regulatory landscape and ensure compliance with relevant laws (e.g., securities regulations, AML, KYC). | |

Conclusion | Successful token deployment requires meticulous planning, technical proficiency, and strategic marketing. |

Engage with the community and continuously improve the project to ensure long-term success in the DeFi ecosystem. |

Frequently Asked Questions

What are the key benefits of deploying a token on a decentralized exchange (DEX)?

Deploying a token on a DEX enhances security, transparency, and control over assets, offering direct peer-to-peer trading without a central authority. This can increase the token’s liquidity and visibility, contributing to the project’s success.

How do I prepare for deploying my token on a DEX?

Preparation involves designing the token by choosing the appropriate blockchain and defining its purpose, setting tokenomics, creating and testing the smart contract, and ensuring its security through code audits and professional reviews.

What steps are involved in listing my token on a DEX?

Listing a token involves choosing a suitable DEX, adding liquidity by depositing your token and its trading pair into the liquidity pool, and establishing trading pairs. Continuous promotion and management are crucial for maintaining trading activity and community engagement.

Dive deep into the world of tokenomics and feature planning to equip yourself with the tools and knowledge needed to create a digital asset that not only functions efficiently but also appeals to a broad audience.